Unfortunately, taxes are unavoidable

And sales tax can get pretty complicated, especially here in Colorado.

For example, in Fort Collins, there are State, County, and City sales tax regulations and two separate entities to remit taxes to after collecting them from customers. If you’re unsure of the sales taxes in your area, check out this nifty tool.

Side Note: don’t get me started on Home Rule Sales Tax .. that particular hellscape deserves it’s own blog post 🙄

Make sure to do some research and set up your sales tax before you start selling goods or services. If you’re online, you’re in luck. The majority of e-commerce software programs should take care of most of this for you.

Shopify is the largest e-commerce provider and has dramatically improved in this area. They now offer free sales tax calculations (assuming you generate $100k or less in revenue). The key step in your store setup is making sure all your products are correctly categorized and marked as taxable. That way, when your customers enter a shipping address, the site calculates the tax payable based on their location. Check out Shopify’s info on tax settings for more guidance.

For brick & mortar retailers, the initial tax rate setup can be more complicated. Make sure you update your point of sale (POS) system at the global level. It’s also a good idea to set each tax rate up individually and then group them into a Tax Group. This way, your sales tax collections will flow into your accounting software more accurately (ask a bookkeeper or CPA to help you with the initial setup if you’re struggling). These kind of settings are a pain in the butt to correct after the fact.

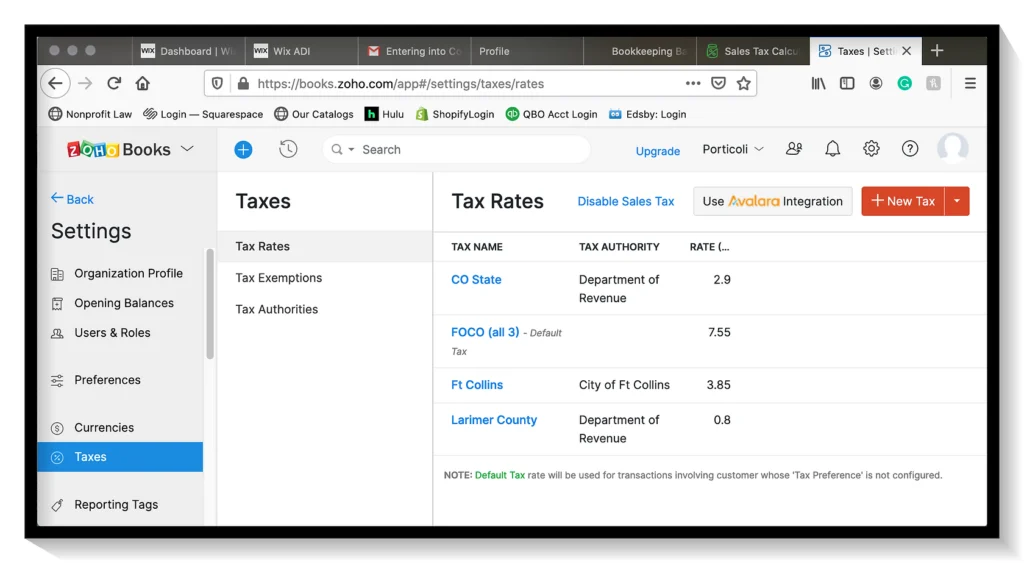

For example, in Ft Collins I would have three tax rates, two entities, and one tax group. Check out the detailed instructions from Zoho for a good example of how to set these up. And below is a screen shot of my own tax settings here in Ft Collins, Colorado:

Note: sales tax has risen in Foco to 8.05% since I created the above graphic but the setup is the same

Lastly, if you have tax-exempt products or customers, you can set up exemptions directly in your e-commerce store or POS. Once again, it’s best to set these up at the global level, rather than having to apply exemptions at point of sale. For example, here are the instructions from Square on how to manage tax exemptions. But just remember, most of these software platforms use similar technology. Once you understand how much tax you should be collecting and which entity each percentage flows through to, you should be able to set it up correctly before you start doing business.

This is Part Two of a longer blog post: Top Ten Bookkeeping Basics for Retailers

Part Three of this series goes into more detail on tracking your cash flows.

Feel free to email me any follow up questions you have or leave a comment below.

Justine Reed has an undergraduate accounting degree and a Masters in Business Administration. She owned and operated two brick & mortar retail stores in Colorado for 16 years before attempting (and failing) to retire in 2020. She continues to work part-time as a bookkeeper and consultant for other small businesses.